Content

A business has incurred legal fees related to a dispute with another company. The cost of the fees they will incur could fall under the “miscellaneous expenses” account. To be more specific, an investment cost would include losses from selling property or shares on the stock market at the wrong time or because the market changed. On the other hand, miscellaneous expenses refer more specifically to What Are Miscellaneous Expenses? day-to-day costs that don’t bring in any money, like grocery bills and travel costs. You may need to attach other tax forms as well, depending on the kinds of deductions you’re trying to claim. For example, if you’re an employee and you’re trying to deduct your business expenses, you’ll need to complete Form 2106 or Form 2106-EZ. Then you’ll attach that form and Schedule A to your tax return.

Sign up to a free course to learn the fundamental concepts of accounting and financial management so that you feel more confident in running your business. Keep in mind that, as a small business owner, you may have some restrictions, such as those on the amount of interest that’s deductible for purchases of vehicles and vacant land. If you have a home office, deduct your interest on your home mortgage as an expense related to the business use made from your home. Guidelines for claiming home office expenseshave changed in most countries as more people are now working from home.

Miscellaneous (Misc.) Expenses in Accounting: Defined and Explained

Tools and supplies refer to items that are necessary for the operation of your services, such as small tool expenses, and can be categorized as miscellaneous expenses. Typically, tools with a lifespan of one year or less are worth less than $200 and would fall under this category. Costs of personal care attendant services required for disability accommodations are allowable. Costs may include fees and travel expenses of the attendant. Documentation is managed by the UW Disability Services Office. Miscellaneous expenses could include x-rays, drug tests, and other additional treatments beyond the primary provision of care.

What is the simple definition of miscellaneous expenses?

Miscellaneous expense is a term used to define and cover costs that typically do not fit within specific tax categories or account ledgers. Regular, extensive, and ongoing expenses, such as payroll, office rent, and inventory supplies, will all have their own account to track and record associated costs every month.

The rules for writing off computers and other equipment are above. Yes, you can write off clothes for work as long as they’re necessary for your job and you can’t wear them in your everyday life, according to the IRS. The ‘Add Other cost’ interface shows the list of your scheduled tasks and the amounts allotted under the head ‘Others’ in your estimate. Amount Paid- The amount of money paid to the vendor in that instance.

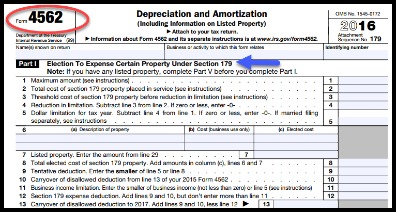

Budget for Miscellaneous

Boots that can be work in your everyday life can’t be deducted. Even if you wear your boots exclusively for your job, if they could be worn off the job, they can’t be written off. Use Form 4562 to claim the depreciation deduction for a computer you began to use for business in 2017 and after, as well as the service 179 deduction mentioned above . The instructions for Form 4562 will help you figure out how to calculate depreciation. No, you can’t write off the cost of a new computer for work.

What is an example of miscellaneous?

Something miscellaneous is made up of an odd bunch of things — things you might not expect to go together. A breakfast bar, a DVD, and a credit card bill are miscellaneous items that may be in your backpack.

Tax Preparation Fees – You can deduct tax return preparation expenses accrued in the year that you pay them, such as software or filing charges. However, you cannot deduct the convenience charge for paying your tax by credit card. If you are preparing your current year 2022 Return, the easiest and most accurate way to find out what deductions you can claim on your tax return is to start a tax return on eFile.com. Based on your answers to the tax questions, we will determine what deductions you might qualify for.

Popular Resources

Explore direct expenses examples and indirect expenses examples. Miscellaneous Expenses.One month salary to cover miscellaneous expenses. Enter your traditional business expenses for each https://kelleysbookkeeping.com/ category on lines 8 through 26 and line 30. In accounting, miscellaneous expense may refer to a general ledger account in which small, infrequent transaction amounts are recorded.

- Keep in mind that, as a small business owner, you may have some restrictions, such as those on the amount of interest that’s deductible for purchases of vehicles and vacant land.

- A company needs to make a charitable donation to a local organization.

- They typically cover small, non-recurring expenditures, such as items bought for the office, business trips, and other similar fees.

- Now, Schedule A is only for individuals and is not often used by tax filers because most people take a standard deduction for unreimbursed employee expenses.

- Travelers should keep in mind that billing for Tolls By Mail is not instantaneous and that any late charges will not be reimbursed.

Also, most miscellaneous costs can’t be deducted from your taxes as some other business costs can. They can therefore have a significant impact on the net profit of an organization. Businesses should track and write down all of their miscellaneous costs to reduce their financial burden and save as much money as possible on taxes. Making informed decisions is a crucial factor in any successful business. Keeping track of miscellaneous expenses is a good way for owners and managers to understand their financial situation, which is important for making smart decisions.

Overnight Travel

Business Telephone Calls, Telegrams, Internet Access, Hotel Business Center Charges, and Facsimiles made for official business purposes and paid for by the traveler may be claimed on the Expense Report. A full explanation must be stated in the Comments section on the Expense Report with supporting documentation attached to the Expense Report. Oregon State University funds may be used to pay for a variety of miscellaneous expenditures when there is a university business purpose and approval is provided from authorized budget personnel. You can claim as many miscellaneous expenses as needed, provided they meet the IRS requirements outlined in IRS Publication 535. Businesses must assess their need for each item and then consider the item’s value in terms of what it will bring to the industry regarding money saved or earned to calculate miscellaneous expenses.